Craig McNeill: [00:00:00] Welcome to episode two of mPowered’s latest series The Future of Personal Training. I’m here with Jack, our co-host for this series. How are you Jack?

Jack Malin: [00:00:12] Yeah, good thanks mate, how are you Craig?,

Craig McNeill: [00:00:14] I’m very good, mate. I’ve been out for a workout this morning. So I’m feeling fresh -spring is here.

Jack Malin: [00:00:20] Can’t say I’ve done the same. So erm, I feel very inferior to you, as always!

Craig McNeill: [00:00:26] We’ve got some big legends with us today, Jack, bigger than us as legends in the fitness industry and (we have) Aaron McCulloch, managing director and James Lorey operations director at your personal training, UK. Guys. How are you?

Aaron McCulloch: [00:00:41] We’re good, how are you?

Craig McNeill: [00:00:42] Awesome. How many years has it been since we, uh, we were actually literally working together?

James Lorey: [00:00:47] I think we all had hair back then Craig didn’t we? So it’s a while it’s a while ago. Okay.

Jack Malin: [00:00:53] Speak for yourself Lorey, me and me and Aaron, up there are holding on here

James Lorey: [00:01:02] My face has turned upside down in that time. But I think it’s probably about seven or eight years altogether chaps isn’t it? So it’s a. It’s been awhile

Jack Malin: [00:01:11] A long time since the nights out on, uh, on Broad street in Birmingham.

Craig McNeill: [00:01:16] Yeah that’s, that’s where we really got to know each other.

Jack Malin: [00:01:20] That’s a conversation killer on a podcast. Isn’t it? Cause no one knows where you can possibly go from that.

Craig McNeill: [00:01:24] I’ll jump in and give you a background of, of these guys and what they’re doing. So. They are, they’re heading up the nation’s leading personal training company in the UK. So these two know a thing or two about being successful as PTs. And also leading PTs to become successful in their own business. So they, they now run Your PT. They support guide and help PTs become successful all over the UK. Uh, and we, we want to kind of make sure that we, our listeners know a little bit more about you guys. So Aaron if you want to give us a short description and an introduction of yourself and your background, and if you’ve listened to our other episodes, we have an interesting fact session, which I need you to to comply with mate if that’s ok.

Aaron McCulloch: [00:02:10] Um, as Craig mentioned yes both James and I have been around the block as it were. So my career started as a personal trainer with Fitness First, was there for a couple of years, went across to, to Your Personal Training, which will be 12 years in September that I made that switch, did very well as a personal trainer, obviously running my own business, started helping other personal trainers that were sort of newer to the industry. And it’s just kind of gone from there. Really. So. PT business support area management became a regional director. Um, and then last August becoming the managing director and co-owner with, uh, of your PT with James. So it’s been a bit of a change of pace in, in that regard. Interesting facts. I mean, I don’t know if it’s interesting, but it’s a, it’s a little bit unique. I think when I was a bit younger, I was the, uh, one of the finalists for the search for the Coca-Cola kid for the 98 World Cup in England. There’s not many of us that were down there. So it’s a small group.

Craig McNeill: [00:03:06] Mate, just interesting, another interesting fact, how many cars have you wrote off with the amount of mileage that you’ve done in the last 12 years then mate?

Aaron McCulloch: [00:03:13] In the last 12 years, I mean, even in the last four, three.

Jack Malin: [00:03:19] Aaron was the only regional director whose region covered from Cumbria to Suffolk.

Aaron McCulloch: [00:03:24] It ended up being South end in the end as well. So it went a bit further down than that in the last couple of years. So yeah, I’m committed or crazy.

Jack Malin: [00:03:34] And now I have the four hour commute of Bury St Edmonds to the office in Manchester, which is a seems round the corner, I guess, in comparison.

Aaron McCulloch: [00:03:43] It’s a lot quicker than it used to be. Yeah.

Craig McNeill: [00:03:45] Awesome. James, Laurie, your turn

James Lorey: [00:03:47] Over to me. Thanks Craig. So yeah, my background I’ve been in health and fitness over 15 years and I kind of, I started my, my entry into the industry. I graduated from Loughborough university. And then started working with commercial gyms initially. So the likes of JJB Fitness back in the days, and also I run a few health clubs. We have a sport, the health clubs, uh, for a, for a number of years as well. So slightly different to Aaron’s route. It was, it was very much the commercial operational side of the business that I was first involved with. What I found after a few years kind of willing around the commercial sector was, I actually, wasn’t ticking the box of why I got into the industry in the first place. I wasn’t working with members, motivating clients on a day-to-day basis. So I joined Your PT in 2011. So a year or two after Aaron and started building up a PT reputation. Uh, started working and coaching personal trainers, uh, much the same, you know, as of kind of August last year we took over the company. We, we, uh, you know, in the process of re mobilizing ready for relaunch, uh, we’re really excited to, to get the gym doors back open, and I get back to work full time. In terms of interesting facts. Okay, this could go quite dark, but let’s keep it late.

Typical Welshman Craig, so you know obviously I’m an ex rugby boy at heart, uh, and the typical sort of power athlete I would say, but. I would use athlete as a very loose term, um, endurance, endurance is completely not my bag. That’s for sure. But what I have committed to this year in September, I’ll be participating in the four by four, by 48, which is effectively, you’ve got to run, walk or crawl four miles every four hours for 48 hours. We do it as part of our efforts, our charitable efforts in 2021 towards Help The Heroes Aaron and the rest of the Your PT team will be joining us on that venture. So that’s my interesting fact for the day for you.

Jack Malin: [00:05:58] Awesome. Awesome.

Aaron McCulloch: [00:06:00] See you guys are welcome to join that by the way, we’ll be holding it in Manchester. So you’ve got no excuse.

Craig McNeill: [00:06:05] I think I’m busy that day…,

Jack Malin: [00:06:10] When it gets back to normal by September. So we’ll put it down on the maybe list Staying on rugby, James, how was that? How was Saturday night?

James Lorey: [00:06:18] Yeah, Saturday was great. Uh, Jack, as I said earlier, I think the TMO is still reviewing the footage. Um, so I think Wales might actually edge that at the end by the time the match is over..

Yeah. Uh,

Jack Malin: [00:06:29] I did think it was a bit controversial when Craig booked it for this week, oh, fucking hell. We’re gonna have to deal with Lorey after a grand slam win. And, uh, 70 minutes before that was still absolutely the case, but. Typical French, I guess what might be typical Welsh depending on which way you look?

Yeah,

James Lorey: [00:06:43] a hundred percent, but I think I’ll run just a luck. Just about run out in it in the, uh, in the last couple of minutes.

Jack Malin: [00:06:49] It’s a dark day for an English rugby fan when your only er, your only enjoyment is watching Wales lose.

James Lorey: [00:06:54] Jack, isn’t it. At least we weren’t playing for the wooden spoon this year. Like you boys so, uh, it’s all good news.

Jack Malin: [00:06:59] Battling it out with Italy at the bottom.

Craig McNeill: [00:07:01] Yeah. I have no idea what you want about, because I think I was busy watching Ant and Dec take takeaway Saturday night takeaway. Aaron I’m going to, I’m going to kind of kick us off, really and talk about when we look back at 2021. How important is it to discuss IR 35 and the new legislation. What that brings? You guys at Your Personal Training released a white paper recently and really, really awesome insights to what it is. And a little bit more background. Well, a lot more background of what it is. What’s your thoughts about the importance of it and how operators need to make sure that they are compliant?

Aaron McCulloch: [00:07:34] I mean, it’s, it’s going to affect a, a large proportion of the industry. I think it’s, you know, it’s been a conversation for the kind of last two or three years, you know, with always have, uh, just to kind of give it some background. It’s a, it’s a reference to a tax legislation, which assesses whether people are contractors, employed or self-employed. So there’s been a little bit of, of ambiguity with kind of personal trainers, freelancer’s, class instructors and whether they’re kind of considered employed or self-employed. And gyms have for whatever reason, always sort of skirted the fine line between that. So, with this kind of legislation coming in on April the sixth this year, um, it was delayed 12 months due to kind of COVID just to give everybody a bit more time to kind of go into it. Some people kind of viewed it as being disastrous. Some people welcomed the change in terms of obviously, you know, personal trainers and instructors, uh, that would have been classified as employed, working as self-employed or kind of off the books of payroll, gym instructors.

So, you know, a lot of personal trainers have done that previously. There’s been quite a few gyms that have made the transition and, you know, instead of sort of paying salaries, they’ve been doing three hours for the gym in lieu of paying rent. So I think we all probably know plenty of gyms that have done that previously, that may be changed and some that are still doing it.

So it’s those that, you know, if they’re doing inductions, group exercise classes, cleaning, if they have asked for time off work and things like that, they could be deemed an employee, which people listening to this, they might be looking within their own sort of business or their own structure. Or there might be a personal trainer that is doing that, they might find themselves thinking that well, actually I’m an employee and HMRC might deem me as an employee rather than being self-employed.

So a lot of gyms have had to make the transition across, which many have, I think it’s been a conversation piece. I think initially started in about 2017 with the Gym Group had their kind of initial practices looked at in terms of how they work with PTs.

Um, and then they were given a bit of time to transition across which I believe they’ve pretty much fully done that, but, it’s going to leave some gyms in a little bit of a, a pickle and not very much time to fix it because they are still engaging these people as gym instructors, as self-employed PTs, and from April the sixth depending on the size of the business and obviously what they do for their, for their work, they might not be able to use them anymore. So some gyms might find themselves in the situation when we go back on April the 12th, that a week prior to that, they’ve got no gym instructors because all their PTs should be deemed as employees. And that process takes months and months and months to transition. And they’ve got what about three and a half weeks to do it!?

And the reason we did that white paper is because people will look at it and not really understand how it affects the industry. So we’ve kind of worked with our solicitors at Irwin Mitchell to kind of break it down, give them an understanding of how our industry operates.

They can give us a breakdown of exactly what it means for everybody. And then we produced this white paper. So even James and I can read it and understand it and know who’s going to be effective and who isn’t really.

Jack Malin: [00:10:50] And is the, it’s the biggest problem that we see the kind of gray area in the middle? So when in real layman’s terms, if you’re fully employed, you’re fine. If you’re fully self-employed, you’re fine. It’s this area in between, like you ref- you referenced the, probably the most obvious example of this, where PTs are exchanging their time in lieu of rent. Is it that we’re concerned about the industry?

And I guess for our listeners that run gyms or our listeners that are personal trainers, is that the, if they’re, if they fall into that middle ground, is that the people that should be. I was about to say concerned but at least looking into this in a lot more detail over the next couple of weeks?

Aaron McCulloch: [00:11:23] Yeah, they could be, most of them may have already been looking at it, but definitely those that aren’t, they, they would want to go and do those checks and look at how those services are being provided.

So if they do feel, if they’ve got a PT or instructor who is obliged to deliver a set number of working hours or their, their shifts are set for them, or they’re given particular tasks or they’re told what to charge, or they’ve got to do a set number of classes or they’ve got to do cleaning, and this is the way you’ve got to do it, they’re not self-employed they would be deemed as employees.

Um, you’re absolutely right. There’s the obvious one is, you know, those, those sorts of PTs that are providing classes and gym instructor hours in lieu of, of not paying rent or even for a reduction. You know, if you do these hours for free, we’ll reduce your gym rent or we’ll completely get rid of it altogether.

It just takes, you know, one, one question to come out. One solicitor to take a look at the agreements, um, to, to factor it through. And obviously then the, the entire business that they’re working for or working with will have to put everything under review, which is something that we’ve suggested they do as soon as humanly possible, basically, which is now.

Jack Malin: [00:12:39] So you’re you guys, I guess for context, deliver a full self-employed model, is that right? I mean, it’s obviously it’s a while since Craig and I have worked with you guys, is, is that. Is that still the model it’s fully self-employed licensed of, of your personal training working within, uh, a club that you’re partnered with?

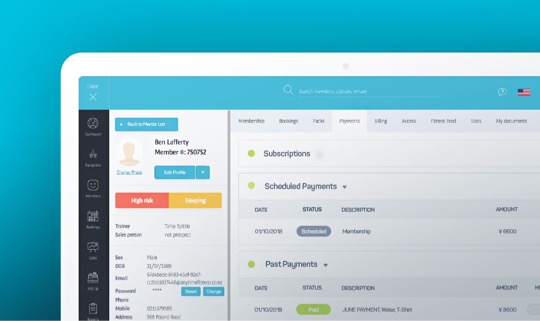

Aaron McCulloch: [00:12:54] Yeah. So we have the kind of traditional self-employed model and personal trainers are exactly that. So, you know, Your PT don’t employ any personal trainers. Um, you know, PTs will pay us for a, a service. So they’re paying a monthly license fee, which, you know, usually it would be the PT might pay a gym just for access to the club.

Like a license to occupy or something like that. Whereas the PTs with us that’s included, but then you’ve got things like the extra support and one-to-one coaching and business courses and things like that, that we do for the personal trainers as well, that are kind of part of a larger package. And once we’ve over the last kind of few months, we’ve actually worked with a couple of operators who were probably skirting the line of IR 35 with their instructors. And what we’ve kind of done with them is created more of a hybrid model, which James has been working on for the last few months directly with, with one of our operators. And he can give you some more insight into the process of that and how we’ve made sure that we separate it and those agreements have been made completely compliant as well.

Jack Malin: [00:14:02] So what’s that Lorey in a bit more in more detail in terms of the hybrid?

James Lorey: [00:14:06] There’s many, many hybrid, uh, approaches now to, to all sort of, uh, business aspects. But in terms, just to put this in context, you know, this does provide a clear, defining line between employed work and worker employed work. And you know, a lot of that is around the sort of tasks Aaron has alluded to, but the hybrid model effectively allows personal trainers to have that blended opportunity in a gym facility.

Whereas if they’re doing gym relevant, uh, gym relevant duties uh, whether it be member engagement or cleaning of equipment and, uh, motivating of members that is, is on, on the payroll they they’re employed by the gym facility. And then they’re also committed then to deliver any personal training outside of their employee times via a Your PT license. So there’s there a complete clear line of definition in between, uh, the two duties. Within Your Personal Training we also support with the accountancy side of the business and the soft skills approach as well. So there’s enormous amount of cross over value in, in the hybrid opportunity.

Jack Malin: [00:15:17] And that’s, that’s really interesting point then. So two PTs can wear two hats. They just need to be really clear different hats versus that kind of ambiguous scenario, they find themselves in where, which they’ve been in for the past few years?

James Lorey: [00:15:29] Yeah. You know, IR 35 sheds, you know, it shines a light in the whole gig economy, doesn’t it?

So, you know, rightfully personal trainers or fitness instructors, um, they should have access to, you know, the, the employee rights. So holiday pay and sickness pay and things of that nature. If they’re deemed to be doing a worker’s role. Um, and as well as the, you know, the self-employed side of it, we all know, you know, the, the benefits, particularly with personal training, um, that we can have within that side of the business as well.

Jack Malin: [00:16:02] That’s it? Right. When the, when PT went self-employed PT works well, it works brilliantly and it’s, we’ve all, we’ve all been there on this call that we’ve all been in the position where you’ve got a full client list and you, and. It’s hands down. It’s probably the most enjoyable job I’ve ever had. It’s, the challenge is I guess, where, where this is going to have an impact probably is on the PTs, that that aren’t that successful.

The ones that were in that in the middle exchanging hours in lieu of rent, because they were all skirting on the line of, could they actually make a living out of this? It’s probably a bigger impact on them. Specifically, it doesn’t it even more so than them, the employers, because this is paying 400 quid 500 quid or whatever it may be for your rent is going to be the difference tween this being viable for some people financially and not.

Is that, is that fair point? Is that what you’re seeing? And that is, does this have an impact then on the volume of personal trainers that we have, because you just take out that middle, that middle kind of not so successful group?

Aaron McCulloch: [00:16:55] I think there’s you, you could probably break that down. You know, the, the personal trainers that were on the, that type of model that, that weren’t paying any rent or anything like that, were were just paying for like a license to occupy, or they were just going into the club, there would be no additional support.

There’s no business coaching or, you know, there’s, there’s nothing personal to them to teach them how to. Speak to people, how to get results with their clients. They’ve quite literally done a course, jumped into the gym and someone has given them a position because they need the gym instructor hours and being able to PT around the side of it kind of works for them.

But now I think there’s with these kinds of positions, like you say, those ones that were kind of. Maybe not fully booked and not doing so well. Is it going to motivate them to maybe try and proactively do a little bit more, or is there, is there an onus on the gym operator to provide those trainers with more support, more guidance and more advice to help them become more successful?

I think there’s, there’s a bit of both, you know, fortunately as, as you guys know that we do all of that for the personal trainers from, from day one, but it’s rare. You know, there’s even kind of marketing personal training in a club. You know, we could go onto, onto a website and walk into a gym and not know that personal training exists, which is kind of a downfall straight away.

Jack Malin: [00:18:20] Completely. And I, and I, I think, I feel, I feel unfair kind of discussing this point with you guys, because I know you guys do an amazing job of it. I’ve seen it firsthand. But so many operators are going to be even more scared now to support their PTs, because this is going to, there’s very little support already for self-employed PTs in most commercial gyms and now there’s this, there’s a lot of fear around ensuring that you’re not. Kind of managing them as it were so saying, right, we want you on the gym floor doing, but I remember our Fitness First days you’d coach, the PTs, you’d say right, go off and find 25 leads and here’s the new member list and all that kind of support in inverted commas that they, they were used to getting.

You can imagine over the coming months, that’s just going to get even less and even worse because there’s this fear of what they can and can’t do it.

James Lorey: [00:19:07] Totally agree Jack. I think from, from an operator’s perspective, the last thing an operator needs to do post pandemic is look after manage and support personal trainers outsource in that is, is a sensible choice.

And of course, with, with our partners at the moment we’re working strategically with them, with their business objectives and our personal training integration, In terms of how they can affect more members, how they can work on club in club concepts, how they can work on in improving the yield of that, their customer base on a frequent basis as well.

So I think, you know, with, with your personal training, what you’re getting is effectively. A PT management company who controls the whole provision of personal training from an HR perspective to an onboarding perspective and a support and mentoring perspective as well. And I think, um, that’s why our length of stay is the best in the industry.

And I think if you think went to, you know, back to when we first got into the industry, how good would a would a hybrid model be to a newly qualified PT. Who has some guaranteed income coming through and the ability to put their skills to good use personal training at the same time. And I think the career development path, we will evolve with this as well for PTs, which is often the number one reason why PTs leave the industry.

It’s it’s finances, but also. They actually think that they’ve reached the ceiling of opportunity and there’s nowhere else for them to go. There’s lots of great opportunities.

Jack Malin: [00:20:38] You say about the hybrid model, because remember when I PT’d that, um, club in Sheffield, it was, it was previously called Greens Health and Fitness, and then they got bought by the partner, De Veer Group, and then ended up being partnered with Nuffield. I had that, they gave me two shifts a week as a fitness instructor. Where they paid me, don’t think they paid me particularly well, but they paid me and it was the best thing in the world because I got paid to do my lead-gen, taught some classes, did some inductions, walked around the gym floor. But then I, I was getting paid to build a business. And I guess that’s the, yeah, that’s kind of the mindset of this, this hybrid model. Isn’t it really, if you get PTs in the right frame of mind, they are there doing what you guys would coach them to do. For free and being paid to do it.

Aaron McCulloch: [00:21:16] Yeah. You know, there has been clubs that have been doing that. Like you say, when, when you were doing it, you were paid as an instructor and then, you know, you could do PT and you probably weren’t paid that amazingly well, you know, if you were employed sort of 10 hours a week by the club, and then you were self-employed. Your income would have been much, much higher, you know, than the sort of gym shares that you’re getting. And that’s always been one thing that, uh, PTs in those roles that when it’s going through the till and they get given a, a percentage of that, is that fair and compared to what a personal trainer would be charging if they were working down the road, you know, if they’re getting nine pounds an hour as a PT before tax I, but they became 30. Two miles away if they were working self-employed and then did, you know, 10 hours, somewhere else employed. That’s also kind of one of those things that it’s now up for debate because you are getting instructors, class instructors, yoga instructors in places like sort of central London that because they know there’s there’s a mass amount of those types of instructors.

Gyms are paying them as little as nine pounds to do a class. So there, there’s now that side of what actually are not being fairly compensated and they’re looking to take those clubs to tribunal as well as everything else that’s been going on with Uber and IR 35 because it’s now going down to individuals like that, that are being unfairly paid.

So it’s finding the right balance and, you know, finding the right people that are going to be motivated to, to build their personal training business. And you’re right. Gyms are going to be a little bit scared going back, because like you say, they’re like, well, How much can I, can I tell them to do? And when you’re self employed mandatory, isn’t in your vocabulary, it doesn’t exist.

So it’s kind of finding that, you know, using the right word in making sure that you’re guiding personal trainers, which is exactly what. You know, James and I, and, uh, and obviously you guys previously, and, and all of our kind of current management team understand the difference of it. It’s almost like you can lead a horse to water, but you can’t make it drink.

So this is why when we recruit personal trainers, one of the big things we kind of look at is. Yeah, great. They’re qualified. And if they’ve done it before, brilliant, but are they coachable? Are they motivated? Do they actually want to be a personal trainer long-term or is this like a six month stop gap before they go and do something else?

So it becomes quite a laborious task. And if for some gyms that they. I don’t want to do what I’d have to time to do.

Jack Malin: [00:23:40] That’s a really good analogy, right? We know that you need to lead the horse to water, but a lot of PTs seem to feel like they want to lie on the beach and you’ve you, uh, you hold a pina colada for them and then drink it for them even.

Craig McNeill: [00:23:51] Some don’t even know they’re a horse to begin with. They’re that far away from it.

Jack Malin: [00:23:59] That is the reality. I think in so many cases that they, they want the best of both worlds of being self-employed don’t they they want the, if it goes right is absolutely 100% down to them, they put in and when it goes wrong, the straight on the phone to you guys or.

That they’re equivalent and I’m blaming them for all the external reasons why it wasn’t successful. So it’s, um, yeah, it’s going to be an interesting, it’s going to be an interesting few months, I think, because as this kind of. Beds in for the industry. Like I said, not, not, not specifically with what you guys are doing, cause I know that’s in a different league, but most broad, more broadly with have operators that have previously just said here’s some space and off you go potentially even feel like their hands are even more tied now.

Aaron McCulloch: [00:24:42] Yeah. Yeah.

Craig McNeill: [00:24:43] This is kind of clearly a topic that has probably taken up a lot of your time and expertise now in terms of just coming back to some key points Aaron if if that’s fair, just. Every thing we just kind of ran through there. What, what would be the key points for our listeners to understand about I R 35?

Aaron McCulloch: [00:25:03] I think the, you know, if people are kind of worrying like, is, is this gonna affect my business? Is this gonna affect my PTs? If they do kind of come under any of that, you know, are they not paying rent in lieu of, of doing hours and that sort of thing, then. You know, even the financial impact on them could be quite significant, not just the instructors, but one thing we’ve kind of recommended people to do is actually go and get, you can get free guidance on this from solicitors.

Obviously we work with Irwin Mitchell who are ours, who are experts in that field and supported us putting the white paper together and, you know, made sure that absolutely we could obviously. You know, help everybody understand what it kind of means to them, but they do have to take, uh, a little bit of responsibility here.

It might be time consuming, but it has to be done. Even if you’re, you’re part of a bigger corporate group. And you’re just say, small company as part of that, you still need to be kind of concerned with it. There is some tests you can go online and do them with HMRC. There’s some initial, we have eight points on our white paper that people can look at, but ultimately they should also see this as an opportunity to consider maybe improving the, what they’re offering. How is this going to help their operation? Is it going to help them retain more members? Because the PTs are going to be, you know, getting their holiday pay there. They’re going to be more inclined to, to come in and do a good job with it. And they’re going to be more focused on, on doing their personal training outside of it, if they’re getting more support.

So it’s, it’s a chance for them to kind of look at it and. Right. Where can we make improvements? Do we have to make any changes and take some responsibility with that and move forward?

Craig McNeill: [00:26:40] Yeah. Awesome. Cheers buddy. Really, really important topic and key points. James, I want to come over to you buddy. And you’ve just mentioned a little bit there in terms of wherever we are in the industry, we’ve got a passion to provide a truly awesome service to, to the end user, to the members or clients.

What does this mean to them? Will they see a big difference in the gym will they will they witness anything at all. And if so, what, what will they experience?

James Lorey: [00:27:10] From a members impact, uh, perspective there Craig I think they they’ll certainly be just some subtle changes. I don’t think a member would, would probably be exposed to, um, you know, big change.

Uh, if I’m perfectly honest, particularly if the, the process of becoming er compliant has been well-managed. If any. So I think, you know, in gyms have kind of internally adjusted accordingly in line with sort of IR 35 regulations. I think for the PTs who they deliver service hours at the gym, they would they’re obviously now more incentivised, you know, as part of this scheme.

And I think as well as the governments and the compliance side of things, the service delivery will ultimately improve across the board from a PT perspective. And I think. You know, I do feel very strongly that personal trainers have a massive role to play in the, in the new role of public health, post-pandemic. Um, and I think, you know, these, uh, sort of strategies will certainly help the members have a better experience and a more consistent experience when they visit in their, their, their gym. And it’s important for, you know, for, uh, for that to be retained as well, because. You know, members clearly enjoyed using their gym facilities, pre pandemic, and they’ll go back to, you know, improved service provision when gyms are reopening again.

Jack Malin: [00:28:32] I think the, the only, the only issue that potentially has on, on our members and again, taking this with a pinch of salt, because, put this in the, in the category of when self-employed PT is delivered well it’s brilliant and put you guys firmly in that category. But if, um, unfortunately we look at the broader industry, the challenge, the challenge is clearly going to be that there’s the inconsistency that members might get with their experience because of the lack of control gyms and now going to have over self-employed PTs.

And I think that. That’s probably, if you, if you sat there as an operator, working out the pros and cons of having employed versus self-employed PT model – parking, the kind of hybrid model, which may be is the, is the ideal scenario. One of the, one of the wins for the employment was surely going to be right?

You’ve got that. You’ve got that control and consistency over the experience. A member gets on the gym floor when they sign up and delivered poorly self-employed PT to members is going to, it’s going to feel even less controlled than it did previously. Now that operators, again, one of the IR35 elements being that you can’t, you can’t control what they’re doing, is that something that you guys, I mean, I know the answer to this, but that’s something you guys clearly are well aware of and conscious of, and try. And like you said, mentioned a minute ago, or are you kind of trying to align yourself with the partners around your partners around that member experience rather than just being a PT, PT provider and that’s that’s vital. You’re you’re the outlier in that, in the group really there aren’t you probably compared to the majority of commercial gyms in that respect?

James Lorey: [00:30:03] Yeah, I’d say so, Jack, I think, you know, it’s all about getting the culture right within a gym facility and that’s something that we pride ourselves on, you know, working with the operators to understand their core values and what the service offerings are to members and, you know, we, we firmly believe that PA personal trainers should be the heartbeat that they need.

Great fitness specifically. I think if you get the right people in the right mind frame and they’re rewarded and incentivised, and they’re supporting, you know, large audiences, this is the, exactly the reason why PTs stick around for so long within our framework is because we, you know, we take the fundamental boxes to, to help them achieve those objectives. And, um, yeah, I think, um, you know, that that’s kind of what we’re entering into. I was, it’s a, it’s a changing world and I think everyone within the industry should be striving to impact more people inside and outside of the gym facilities, PT is just another fantastic vehicle to help operators attract new members, different types of members and engage on a wider basis.

Jack Malin: [00:31:06] That’s it. And all right, is that is the ultimate member engagement and retention tool. Isn’t it PT?Problem is that only that 4% of people take it. And how can we make sure that they get that consistent experience? And that means when they join the gym, but also like you guys emphasize it, the length of stay of the PT.

You don’t want to have new PTs there every week. And there’s nothing, no detriment to the consistency of the experience.

Aaron McCulloch: [00:31:31] That’s sort of widespread problem in the industry I would say is, is the kind of the attrition or the turnover of personal trainers. And it comes back to, you know, are they bringing in the right personal trainers in the, in the first place?

So, you know, for example, when we sort of interview personal trainers and kind of, you know, we get the applications through and all the rest of it. But I think we, the average sort of we put through from start to finish and actually placed them into a club is like 4.6%. So imagine we have like anywhere between 350 and 450 applications a month, that 4.6% is not a very large group, but it is the group that ticks the box of they’ve got the skills they’ve, they’re qualified and they’ve got the right personality, attitude and everything else, whereas many, many facilities, and we won’t name names, but you know, if you turn up, and you can walk in a straight line and you know how to do a press up.

Yeah, you’ll, you’ll be in, I’ve worked in, in, in that environment, you know, at the very start of it, it was like a personal trainer come in and say, Oh, can you teach me how to sort of coach a press up? Was this newly qualified personal trainer? And again, you know, this might go back to even qualifications where, you know, you can, you can go online now with things like 25 quid and you can do a 17 and a half hour personal training course, it’s not accredited in any way, shape or form by anyone in the industry. But if you were just Joe blogs off the street and someone’s like, well, I’m a qualified PT. You don’t know where that person’s coming from. So you’re right. That the quality can sort of vary when you go into a club.

Um, and we have obviously sort of strict minimum levels that we require to go in, but even. The, the biggest commercial gyms that we see all these adverts on TV for and things like that are allowing those PTs who have done those 50 an hour online video only non-accredited courses. They’re allowing them to be PT’d in their facility.

So therein lies the sort of real issue. It goes back to, you know, who’s that who are you letting come in in to your gym floor and it’s your club. You know, we obviously have a vetting process and, you know, the, the gyms are very aware of, of how we do it and actually prefer that we do things that way. So they don’t end up with this revolving door system or a lot of liabilities when it comes to under-qualified or in most cases unqualified personal trainers in clubs.

Jack Malin: [00:33:51] And you, you mentioned a few attributes for trainers there kind of like the skill of the personality the experience, like when you’re recruiting, what do you what’s most important to you guys?

James Lorey: [00:34:00] I think from my perspective, what we coach the regional key team managers to endorse as well, Jack is the PTs coming in, they need to be teachable and willing to work.

Um, when we say willing to work, as, you know, you need to work really hard, especially in the early days to, you know, build up your reputation, build up the client book. So those are the key aspects, but we actually have a 10 stage process. So, um, as Aaron said, it’s not a given – as soon as you put an application into Your PT you’re going to get a role in the gym. We vet the right candidates and make sure that they have the business acumen to be successful because a large part of this say is. Is, um, you know, having that business ability to grow and manage your client base.

Jack Malin: [00:34:43] It’s having that mind the right mindset that you are building your businesses. And that is not that a job that many of them think it is

James Lorey: [00:34:50] A hundred percent.

Craig McNeill: [00:34:51] Also remember, this is not a new thing for you guys to provide your PTs from it from a digital platform. And that’s where we, we worked all together 10 years ago and that’s where we were. We were in that space and we were trying PTs from a digital point 10 years ago.

So. This is really fast tracked that hasn’t it. In terms of what you guys have done over the last 12 months. Now you have provided a digital platform for your PTs, and I wanted to kind of start understanding how that’s gone over over the last 12 months. Obviously the elephant in the room, the pandemic means that members are now not able to walk through the doors where PTs literally used to stand on the gym floor and with all the skills that you’ve already mentioned, if they have all that.

They’d have a, a full client book within three or four months. And it was a really nice business. That disappeared overnight. How are you guys getting on with we’ve launching digital for your PTs and what does that mean to, to the traditional services, to the one-to-one PTs and the small group PT business.

And how has that differed between implementing the last 12 months versus the last 10 years where you guys have tried to trickle that through.

Jack Malin: [00:36:02] It’s um, it’s interesting as well. It comes full circle because you’re right, Craig, it was, it was maybe even more than 10 years ago that we were trying to push Your Lifestyle to PTs and PT for, we have two heads when we were telling them that you could do this without standing next to them.

It’s funny that it’s come full circle back. We even sort of think, say-

Craig McNeill: [00:36:21] We even provided them as an online coaching course as well. Didn’t we?

Jack Malin: [00:36:27] It was a, and they thought we were mental.

James Lorey: [00:36:31] This is it, you were secret pioneers at the time gents. This is exactly, this is where it all stems back to.

Jack Malin: [00:36:37] That’s what I tell myself when what I’m happy when I’m sitting there. I took with my self-talk. So you were a pioneer, you were forward thinking.

James Lorey: [00:36:44] Absolutely. I mean, influencers was, that was definitely a different term that those days as well.

So I think some influence in the market, but you know, the digital space has boomed it doesn’t in the last 12 months. And you know, it’s, it’s an area that we. We knew we need to, uh, to develop it. Um, I think to be fair, you know, Jack and Craig, since, um, your wealth, your lifestyle, um, w was kind of, um, born, um, you know, your PTs really engaged with a digital offering for many, many years.

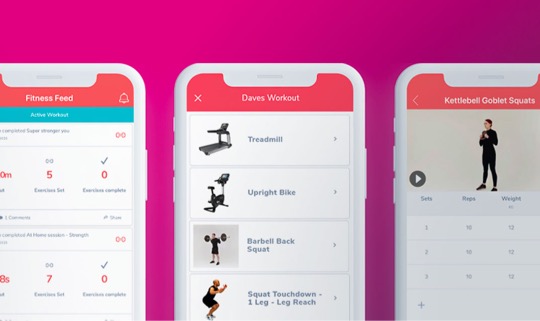

So Aaron and I made a conscious effort to, um, to make sure that we had a product that was suitable to the people that we work with on a day-to-day basis. So. Yeah, you’re right. We’ve launched an app called Your Wellbeing. We wanted to make sure that this app allows PTs to effectively become ultimate service providers within the market.

And the app effectively allows PTs to manage coach and engage their audiences. So it’s with, in conjunction with, with a company called Virtua Gym who we, we worked, we’ve worked on a collaborative basis with. Uh, you know what we’ve kind of seen where we’ve surveyed a personal trainers when we’ve listened to what they need to enhance their business.

We we’ve certainly found that there’s a high appetite at the moment for digital services and for PT to integrate with. So those would kind of look at the app and submitted a contact form. Currently we we’ve seen around 80% of people uptake in Your Wellbeing as their preferred app to use for their PT management.

So we’re really pleased with the outcome and we’re really looking forward to, uh, really utilizing that to its best effects over the next few years.

Craig McNeill: [00:38:29] Yeah, absolutely. And it’s another tool, isn’t it for the PTs? Well, just interesting. What, what were the things that you were looking for? What were the, what were the top three aspects of it, of a digital platform that you guys wanted to, for it to have to implement?

James Lorey: [00:38:44] Well, I think those key aspects of the three pillars are really the culture and integrations. The ability to, you know, build training plans, build nutrition programs. Um, have that ultimate sort of accountability from a client perspective is really important. Then the engagement side of it was more along, almost creating clubs in clubs, uh, personal trainers have the ability to do this on that so, you know, having a group of people who, you know, have like minded goals, like weight loss of strength and conditioning, Um, uh, communicate into that audience simultaneously and then the ability to manage your payments as well is the third pillar Craig so I think those three aspects of certainly what personal trainers have fed back to us and what we’ve tried to create with your wellbeing.

Craig McNeill: [00:39:30] Um, what’s your thoughts about when we reopen next month? What’s obviously crystal ball in front of you here James, by the way, what’s your thoughts on the next 12 months in terms of how, how are the PTs gonna gonna use the new platform and are you gonna see a shift in what they do in club? And they, are they going to then become that hybrid where they’ve got a digital service and that one-to-one clientele?

James Lorey: [00:39:56] Well, I think we’re all rested after the last year Craig so it’s time to roll our sleeves up and get stuck in again, not wait, but I think I’m no a hundred percent. I think, you know, personal trainers, what we’re finding from a member’s perspective and a PT perspective is it only it should to get back into the gym.

Everyone’s you know, fed up of, you know, the training in their in their underpants in the living room. And so they want to get back into the gym.

Jack Malin: [00:40:20] Now they want to train in their underpants in the gym.

James Lorey: [00:40:24] There’s a niche market there Jack, we will have a separate conversation on that one. Um, you know, certainly what, what we’re going to see is as soon percentage of PTs, I believe will migrate to, you know, fully online training.

Um, the, the develop, their skills, they develop their, their you know, their ability to capture audiences. And I might move, you know, straight into that online, which is great. It can influence many, many people, other PTs were going to just stick the face to face training. We firmly believe that the, obviously the gym space is, is a great audience, a great opportunity for those individuals.

And then you will have some people, you know, hybrids hybrid coaching as well. I think there’s the risk associated with, with PTs as well. These days, again, gone up the risks 10 years ago is that they’re also. Working against influencers online as well. So it’s wherever the consumer can differentiate between a trained fitness professional and someone, you know, who looks great in their pants, in their living room.

Absolutely. None of us would have made it.

Jack Malin: [00:41:34] We all fall into the former category, right. If it was going to be success, er judged on our abs and Instagram followers. Um, think we’d be at, would be struggling and a couple of stones heavier then you got about 50, 50 friends or even friends followers on there.

Craig McNeill: [00:41:53] James, in terms of what you’ve witnessed in the last six months. Have you got any nice stories of any success? Examples of when a PT. Literally says, no, I’m not doing this app thing. And we then witnessed a move, a shift, a tide, where they then actually become a really big advocate in terms of a success story of how they actually make that transition.

It’s a wrong phrase because it actually, that sounds like it’s bigger than what it is. Maybe it’s a, it’s a slight shift to the left.

James Lorey: [00:42:26] I think it’s more of an integration. isn’t it rather than a transition? I think, um, you know, we, we only launched this app in, in February, um, you know, took a few months to develop and get it to the right level of what we wanted.

Um, but in terms of the early adopters, we, we’ve got a good story. This is two gentlemen based in Halifax, they run a personal training studio who would basically, you know, um, relying on, on, on the grant funding over the last couple of months, but struggling to engage their clients, struggling to keep them on track.

They, they were one of the very, very first adopters of Your Wellbeing. And since what, six, six to eight weeks has passed since they started using it, they’ve increased their revenue by 1600 pounds per month. Um, by integrating their members, getting them onto an almost an upscaling platform with your wellbeing and offering them something different.

What the members were interested in was the accountability and staying on this road, the lockdown period, which many, many people have found really, really tough to really keep on track with that their health and fitness goals. So they’ve seen some fantastic results in a short space of time. Uh, much like operators, personal trainers should all be treated in a business as a business and looking at how they can optimize yield with, uh, with their pay and members as well.

And, you know, improving their service provision, offering something different and, and almost creating that menu that we often talk about in health and fitness will allow them to capture a wider audience.

Jack Malin: [00:43:57] And digital finally allows them to really do that. Doesn’t it? I think we’ll come to those kind of pricing opportunities. I mean, previously, other than sort of scaling the session by having multiple people in it whether that small group, a large group, they’re very limited options, but that’s what the, wherever it is a hybrid, wherever is a truly digital offering is that it’s the first time where we really can start to have tools that engage the, the full membership base.

And the ironic thing is I think we were almost telling , talking about the fact that we want trainers to become more like gyms and focus on having products that can, that can support multiple people and running recurring revenue, beat base based businesses. And you always want games to run more like trainers and focus on engagement with members and retention rather than just the revenue that PT, PT generates.

There’s got to be a sweet spot somewhere in the middle that works both for PTs and, and, uh, and operators and becomes mutually beneficial.

Craig McNeill: [00:44:50] Yeah. Aaron, in terms of coming to you with w we’ve kind of a round up of the importance of everything that we just mentioned about getting the legislation right.

With the IR 35, making sure that you get the PT model right for your business. What’s your thoughts about the operators placing enough emphasis on, on personal training, as a model for their own clubs? Obviously they’re looking at ultimately sales and retention and making sure that they have a successful business.

How does that cascade, in your opinion, to actually understanding the importance of whether personal trainers are in that process?

Aaron McCulloch: [00:45:27] That’s a good question. I’ve been kind of previously, would I say that that most gyms. Have, uh, uh, any emphasis on personal training and take any interest would be 90%, I would say, no, they don’t, they they’re not supported.

They don’t maybe push it enough. We’re very fortunate that, you know, we have a collaborative approach with all of our gyms and we actually get to work together on it. But especially now, I mean, unfortunately the, the sort of last year has had an effect financially. On on every club, which means a lot of them are, uh, downsizing, obviously the demands of fitness instructors, you know, there’s cleanliness and hygiene standards have increased.

Um, they’re not going to be allowed to drop over anytime soon. There’s less. Fitness instructors because of obviously cut backs, they’re kind of policing the gym floor as it were to make sure that people are social distancing and cleaning up after themselves. So I think personal trainers now are probably more important to, to gym, not just in the fact that they, they get results and you know, you can get results in the gym, you’re going to stay and then you’re going to refer your friends.

So that’s a really simple process that I hope everybody understands in terms of why people stay at the gym, but ultimately 10% of people that come to a gym actually get results. So gyms have never really delivered on that promise that come here and you’ll, you’ll, you’ll get the body or the, you know, the, the mindset or, you know, that the health and fitness benefits that you want.

That’s actually a personal trainer’s job is to get results with clients. Um, ultimately now they’re going to be the ones that are. Interacting more. They’re going to be coaching more, you know, especially if we’ve got, uh, a sort of digital solution as well. It means they can have a wider reach. And over the last year they’ve been developing their own client bases, their own kind of communities online.

And now I’m going to attract people into the comp as well that they’re at. So there is absolutely. It is mutually beneficial. The gym’s putting more emphasis and a bit more support into the personal trainers and the personal trainers are going to be able to help them retain their members, but also bring new ones in at the same time, which is a win-win in my book anyway,

Craig McNeill: [00:47:33] Completely. No, absolutely. And I completely agree with everything you said and just listening and kind of receiving and how you’ve just articulated that as well. Just so important to get this right. And with the help from you guys and. Help from experts so important. And it’s only going to have a knock on effect. It’s going to have that domino effect throughout your business.

Really important.

Jack Malin: [00:47:56] And I think PT, that is the best possible way to get those results. I think, as you mentioned, Aaron, only 10% of people getting results they wanted to achieve, and they turn up to the gym. That is not a surprise. The industry churns its whole membership base each year when only one in 10 people actually achieve what they set out to achieve.

PT has got to be the best way to, to, to achieve that. And what you guys do with digital, what you guys do in supporting that is ultimately is allowing them to access more of the members. And help them in, in different ways versus it just being one-to-one PT. And I think that the big takeaway I’ve had for speak to you guys is that maybe self-employed PT isn’t isn’t dead is, but it’s got to be delivered in a very specific way and properly.

The real fear here is that there’s that many operators get caught in the, in the middle ground where they, they can’t transition to a proper self-employed PT model. Can’t transition to one where they get the proper support within the PT model. And over the next 12 months, we actually see more PT is just thrown into that middle ground, um, to try and keep it to try and keep, um, revenue coming in from PT rent, which is ultimately where we, we really hope that PT doesn’t end up as we once we get back to reopening.

Craig McNeill: [00:49:09] Yeah, I agree

Chaps we we’ve gone through some really key points there and I’ve kind of wanted to absorb as much as all our listeners as well. So James, I’m going to come to you first, buddy. And in terms of wrapping this up for our listeners, what would be your biggest takeaway from the kind of the conversation that we’ve had today and for our listeners to kind of go and implement and understand more, reach out to experts, what would be that takeaway from yourself, James?

James Lorey: [00:49:39] Um, I think really, um, from a position of an operator and a personal trainer, I think, uh, position yourself to really optimize this industry boom that we’re going to see post-pandemic when the gym start opening the doors from, from April, you know, I think we’ve got a massively important role. To, to, uh, you know, develop, um, the health and fitness of the nation.

So get ready, you know, to impact more members and to really define what your member journey member strategy is going to look like. You know, w whether it is only going to be face to face or online or blended, I think, um, the space between now and relaunch, if you haven’t done it already. Get that nailed down, uh, and always put the member at the forefront of your decisions as well, because ultimately these are the people that we need to keep interested.

These are the people that we need to keep engaged with our industry.

Craig McNeill: [00:50:34] Yeah, absolutely. And what would be, and this is a hard one Lorey what would be the one book? Which would be at the top of your pile to read or listen to at the moment

Jack Malin: [00:50:46] Johnny Wilkinson’s autobiography.

James Lorey: [00:50:50] I developed quite an eclectic book collection over, over the last 12 months.

I can, I’ve read everything from Tyson Fury’s autobiography , Johnny Wilkinson’s on the list. Jack, any don’t you worry about that!

Jack Malin: [00:51:03] Be a more interesting read than Dan Biggar’s autobiography that’s for sure!

James Lorey: [00:51:08] Absolutely. Absolutely. But recently I’ve, um, I’ve read Black Box Thinking I don’t know if you chaps, have ever read that book Matthew Syed is the author.

Uh, it’s a great, it focuses on aviation and how they kind of learn from their mistakes. And I think it’s a really good book for anyone in business. Learn from your mistakes and move on, build strategies so that you don’t repeat the same mistakes over and over again. Um, yeah, that’s

Jack Malin: [00:51:36] That great comparison between aviation that and the kind of medical industry that does everything they can to sort of hide mistakes.

And it’s so slow to slow to learn compared to the aviation industry. That was like I say, has those black book box sessions or processes? Yeah, it’s an awesome book. I think I read that off your recommendation McNeill.

Craig McNeill: [00:51:55] Yeah, it was one of many

Jack Malin: [00:51:57] Probably the only recommendation you’ve ever given me that I’ve taken on board.

Craig McNeill: [00:52:02] I’ve not read it myself. I just listened to people like Lorey and then just, just spread it.

No, it is an awesome book and lots of takeaways from, from that book, Lorey awesome, buddy. Aaron, what would be your biggest takeaway from, from our conversation here, buddy?

Aaron McCulloch: [00:52:21] I think it’s. You know, going back, everybody needs to embrace the changes that we’ve had. You know, we we’re now in a digital space.

What is there another 71,000 fitness apps since this time, last year kind of shows people are maybe interested in it. You know, maybe understanding that that that’s not going to keep people away from the gym. It’s something that they, they might do as well as coming in, you know, people are going to value their health a lot more now.There is a heightened level of consciousness of, of what the effects of ill health can have, even if it’s, you know, being slightly overweight or, you know, not being as fit or not having a very strong immune system. Um, and gyms and personal trainers are well positioned to kind of help people get on back, back on track really until we get them on the right line.

Health is going to be a priority. I think everyone wants the same thing. I think gyms want people to come back and be fit and healthy and come to their clubs and people want to get fit and healthy and personal trainers want to help coach people back to health or get people fitter everyone’s going for the same goal.

So if it’s a case now of. Okay. Embracing what we, what we have to change that maybe it wasn’t perfect before. It was probably never going to be perfect, but we should always work towards it and working together as a is a win-win. And if you know, the, the personal trainers are happy and the’yre sort of busy, and they’re staying longer than the gyms are happy because their members are staying longer their members are getting results.

And the members are happy. It’s a, it’s a win-win all around. If we will kind of embrace one another as it were.

Jack Malin: [00:53:56] Yeah, I think that’s a really, really interesting point. Right? It’s it’s we all want the same thing. Being operators, trainers, and members. But how many PT models do you see when you’ve got this completely disconnected process from what the member wants, what the operator wants and what the PT wants.

And I think that’s, that is a fantastic takeaway. It’s about creating PT models, wherever they’re self-employed, whether they’re hybrid, whether they’re employed, that do align the goals and the needs of, of those three groups is, is where, what we should all be we’ll be aiming for. And it, it sounds so blatantly obvious, but I think is, yeah. Is, um, is not actually present in very many gyms when you, when you go onto onto the gym floor.

Aaron McCulloch: [00:54:36] Yeah, I agree.

Craig McNeill: [00:54:37] Definitely. What would be your book to recommend, to read or listen at the moment, buddy?

Aaron McCulloch: [00:54:43] I mean like James I’ve, I’ve had quite a mix of, of books and mainly audio books for me. Um, I’m, I’m not challenging myself to start reading again.

And like Jack says, I usually spend that much time on the road and probably get through a book every couple of days. Um, the amount of time that I was doing, but, um, I’m about 80% of the way through Can’t Hurt Me by David Goggins. Which is, uh, you know, it’s a brilliant listen um, there’s a lot of kind of takeaways in between.

And then, you know, I’ve also kind of looked at Extreme Ownership by Jocko Willink as well, which is exactly that is understanding. You know, what way or ownership is where your responsibility is, whether you’re a, a leader or not. I think there’s quite a few, there’s quite a few takeaways from that as blunt as some of them might be.

But yeah, I like the sound of the book that James is on at the minute as well. So, um, I’m always happy to take recommendations myself.

Jack Malin: [00:55:37] It can’t hurt me. Yeah. Sounds like a very relevant book for the last 12 months of, uh, of working in the fitness industry. Yeah.

Aaron McCulloch: [00:55:43] I mean about mental and physical resilience, it’s, it’s all in that you also kind of inspired our challenge with Help for Heroes as well, because it’s actually an event that he does because he’s a, he’s a lunatic or we kind of like the sound of it.

One of our guys suggested it and we, we took it and, um, that’s going to hurt.

Jack Malin: [00:56:03] What is it? Four, four miles, every four hours.

Aaron McCulloch: [00:56:06] For 48 hours. Yeah.

Jack Malin: [00:56:09] So you’re doing you probably moving for an hour rest for free for two full

days.

Aaron McCulloch: [00:56:15] Yeah. Give or take, it might get a bit slower on day two

James Lorey: [00:56:20] or pretty much for me, Jack I’m walking for 48 hours,

Jack Malin: [00:56:27] Slow and steady wins the race Lorey skinny backs, you keep going slow and steady wins the race mate.

Aaron McCulloch: [00:56:34] Yeah. The highway maintenance bills are going to go right through the roof when me and James start running. I’ll tell you that. Uh,

Jack Malin: [00:56:40] I would love to tell you the I’m going to join you on it. And end this podcast in a real positive way, but I think it’s highly unlikely, but I will come if you’re in Manchester will come down to the finish line.

Craig McNeill: [00:56:51] Yeah.

In terms of, uh, I’m also aware that you’re, you’ve got some business courses going on at the moment as well for, for PTs. And how can our listeners find a little bit more about your PT as well as that.

James Lorey: [00:57:05] Yeah, cheers Craig yeah. So, um, visit the website, www dot yourpersonaltraining, .co.uk we’d made our business and sales training calls available free of charge to any fitness professionals in the industry until the end of March.

Um, so simply fill in the contact form. Uh, we can send you a, link a cross, uh, to access the, um, the e-learning course. And they said fantastic value in there as well as some really golden nuggets that will help people remobilize and, and really optimize the, uh, the remainder of 20 21.

Craig McNeill: [00:57:44] Awesome guys.

Absolutely. Awesome. Thank you for your, for your time today. It’s been great catching up with you as it always is. We’ll make sure that when that when next time we catch up it will be in person and we’ll we’ll maybe have a, have a drink in our hands as well.

Aaron McCulloch: [00:57:57] Awesome. That sounds like a plan. We appreciate you having us on.

Jack Malin: [00:58:00] It’s been great fun guys. Good to catch up.

James Lorey: [00:58:02] Thanks chaps. You take care.

Craig McNeill: [00:58:06]Thanks for listening to mPowered with your hosts, Craig McNeil and Jack Malin. Connect with us at membr.com and don’t forget to subscribe. In our next episode we welcome Nik and Ant, who are the UK PT Managers for Pure Gym. Tune in for some surprising insights from two legends in the fitness industry. See you soon!